Kuwait Finance house (KFH) is one of the early bank that establish in accordance to Shariah law in Malaysia. KFH is one of the first modern Islamic bank in the world. Today KFH has subsidiaries across the world ranging from Middle east, Europe and Asia inclusive of Malaysia.

| "KFH MURABAHAH PERSONAL FINANCING-i GOVERNMENT PERSONNEL" Pinjaman Peribadi KFH | KFH Personal laon |

| 2 years to 5 years – 5.99% p.a. | |

| 6 years to 9 years – 3.99% p.a. | |

| Minimum amount of loan from RM 2,000 to RM 250,000 | |

| Minimum monthly salary of RM 24,000 p.a. | |

| Minimum 2 years to a maximum of 10 years financing | |

| No guarantor and collateral needed | |

| Shariah and Murabahah based | |

| Malaysian citizens only | |

| Available for Government servant with minimum 1 year of service only | |

| Takaful protection available | |

| Zero penalty for early settlement | |

| Quick Repayment via bank transfers |

KFH Personal Financing-i is a personal loan package that is offered only to government personnel in Malaysia. This loan is fully Islamic compliant and is based on Shariah Murabahah concept. This loan offers from RM 2,000 up to RM 200,000 of financing with minimum 2 years up to 9 years of repayment with overlap option. The interest rates of this loan would be based on amount borrowed and financing tenure. One can enjoy a low 3.99% p.a. with 6 to 9 years repayment while 5.99% p.a. for 2 to 5 years repayment period. Personal Financing-i is unsecured which no guarantor and collateral is needed.

Charges and Fees

Takaful insurance is compulsory with the loan.

Repayment

As of all government loans, the repayment of the loan is done via Biro Perkhidmatan Angkasa (BPA) or automatic salary deduction

Requirement

This loan is only available for Malaysian Government sector. Eligible applicants must be aged between 19 to retirement age at the end of loan. This loan is offered to Government staffs with permanent position and 1 minimum of 1 year in service. The minimum salary requirement would be RM 2,000.00 per month.

Documentation

Applicants will have to produce their IC, most recent payslip and Employment confirmation letter.

- Photocopy Malaysian Identity Card (Both sides)

- Most recent payslip

- Most recent EPF Statement

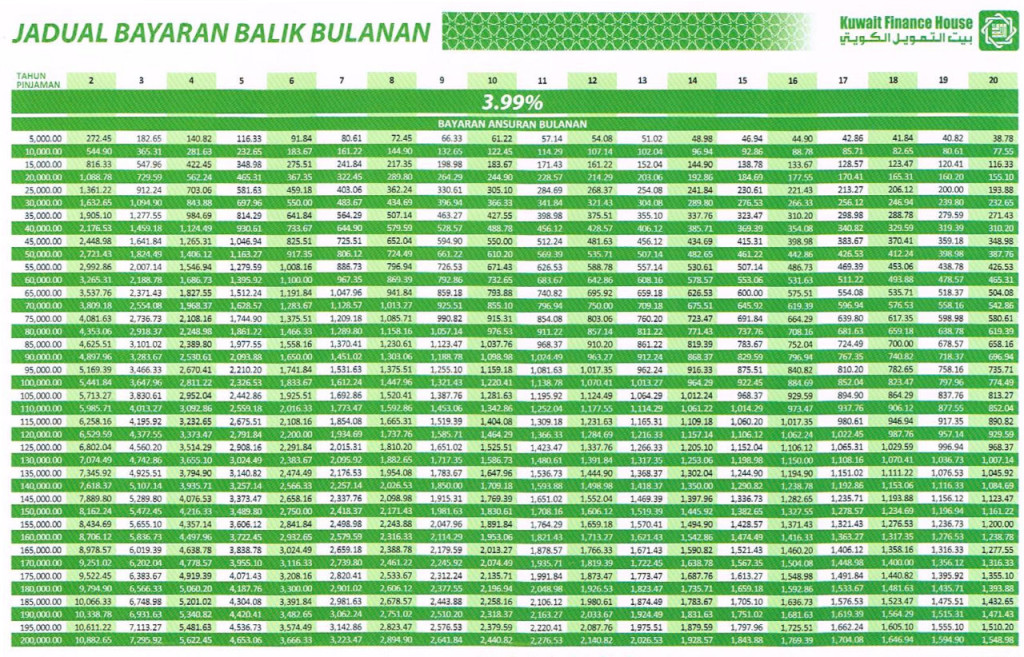

Repayment Table

Pros

- No penalty if you want to settle this loan earlier