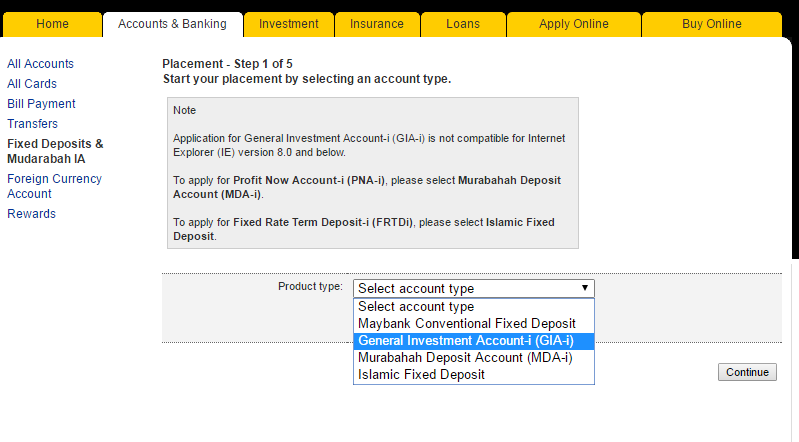

Maybank E-FD is probably one of the most convenient way to make a Fixed Deposit placement in Malaysia. However you probably have seen or wondered what is Maybank GIA-i (General Investment Account) all about.

What is GIA-i ?

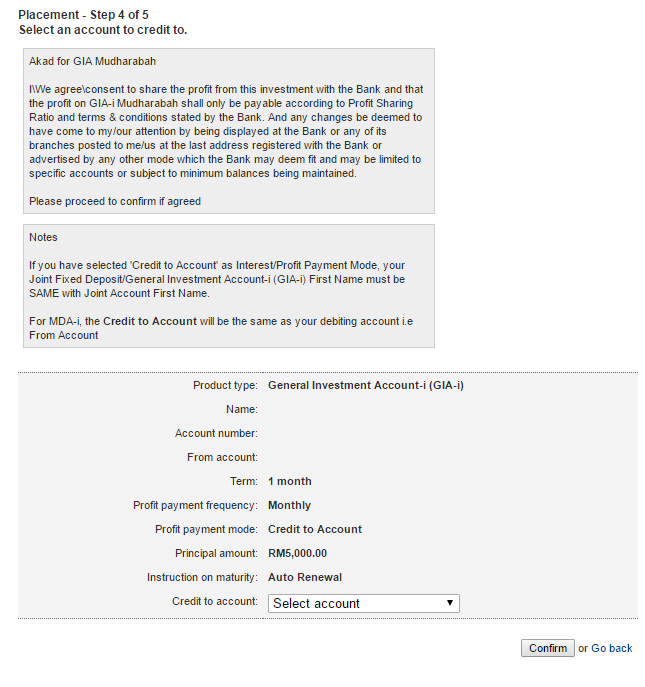

Ok. For a start GIA-i is NOT a fixed deposit at all. Many have also wonder why this option is also enabled on Maybank2u category. Perhaps this action would encourage depositors to consider GIA-i as well. However do that note that GIA-i gives a high 4.0% p.a return for minimum 1 month placement which is comparatively very much higher than most E-FD placement in Malaysia. From Maybank2u website, GIA-i is actually an Islamic Compliant investment account which I assume is sort of like Unit Trust. Do take note the the minimum placement for GIA-i is RM 5,000 for 1 month and RM 1,000 for 2 months or above. This would be great start for anyone would wants to generate quick interest.

Cons of GIA-i?

Everything sounds good, however what are the drawbacks of GIA-i ? Please take note that is not fixed deposit account thus there are no protection from PIDM. Do take note that Maybank2u clearly states that this investment is not covered by PIDM and principal invested is NOT guaranteed. So does Maybank pays the exact published rates of 4% for 1 month placement ? So far , from our experience Maybank has always honored the 4% p.a return. Here are the 4% p.a interest that We’ve tested with our GIA-i account.

![]()

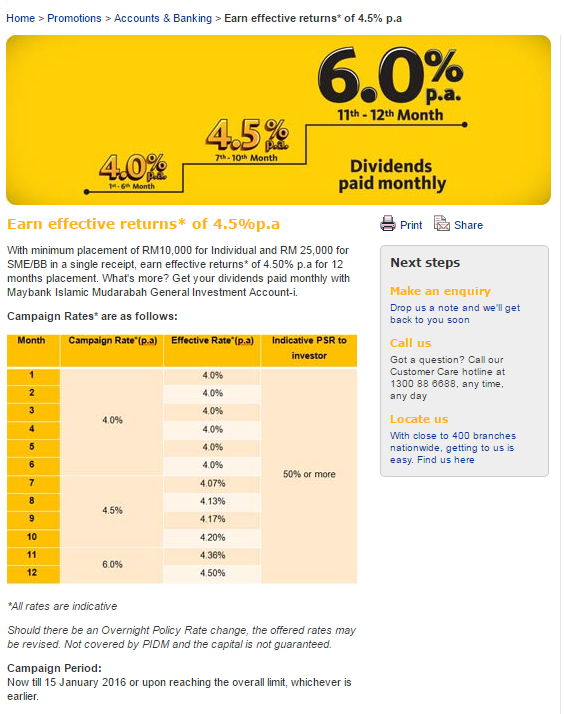

We’ve also spoken with some depositors who have been constantly using GIA-i for years and there were no issues so far. There are also running GIA-i promotion where you can get even higher returns of 6% p.a effective rate of 4.50%.

So should you deposit on GIA-i ? We guess it depends on risk appetite of depositors. We have no issues getting the displayed returns so far. The rate justifies walking from bank to bank to get high returns fixed deposit promotions if you have diversified your investment enough. Everything is convenient where placement can be done at the end of your finger tip. However, it would probably be wiser for depositors who have less funds to enroll in high returns Fixed Deposit promotions which is insured by PIDM.